Apple’s push to replace the chips inside its devices with homegrown components will include dropping a key Broadcom part in 2025, according to people familiar with the situation, dealing a blow to one of its biggest suppliers.

Apple’s push to replace the chips inside its devices with homegrown components will include dropping a key Broadcom part in 2025, according to people familiar with the situation, dealing a blow to one of its biggest suppliers.

As part of the shift, Apple also aims to ready its first cellular modem chip by the end of 2024 or early 2025, letting it swap out electronics from Qualcomm, said the people, who asked not to be identified because the plans are private. Apple had been previously expected to replace the Qualcomm part as soon as this year, but development snags have been pushed back the timeline.

Apple is Broadcom’s largest customer and accounted for about 20% of the chip maker’s revenue in the last financial year, amounting to almost US$7-billion. Qualcomm got 22% of its annual sales from the iPhone maker, representing nearly $10-billion, though that company has warned for years that its Apple’s reliability will wane.

Shares of Broadcom fell as much as 4.7% on the news before paring their decline. The shares closed at $576.89, down 2%. Qualcomm slid as much as 1.6% before closing at $114.61, down 0.6%. Apple rose 0.4% to $130.15.

The moves will further upend a chip industry that makes billions of dollars supplying Apple components. Already, the world’s most valuable tech company has removed most Intel processors from its Mac computers, opting instead to use in-house chips known as Apple Silicon. Now the changes are hitting the biggest makers of wireless electronics.

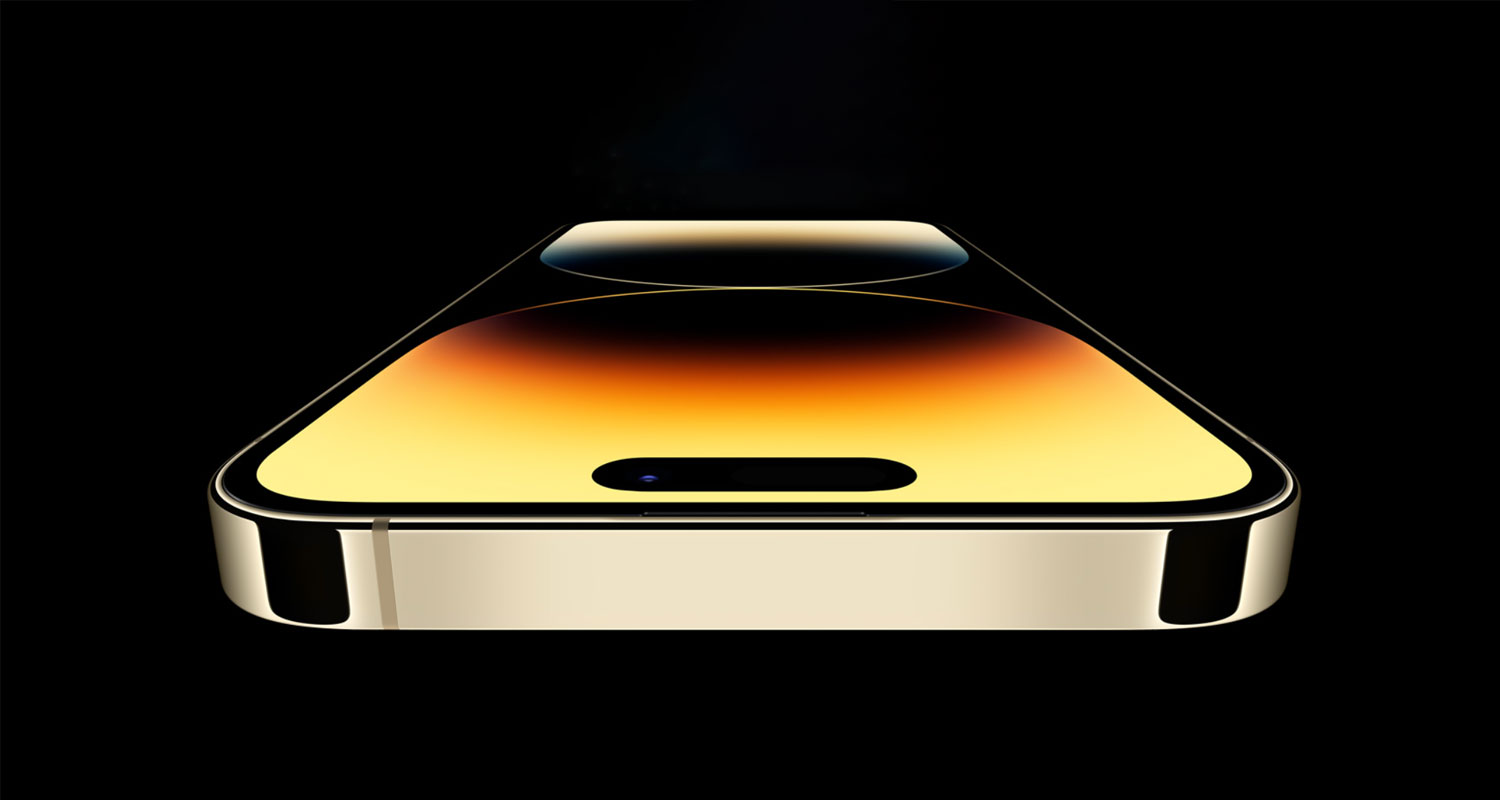

The iPhone is Apple’s top moneymaker, generating more than half of its $394.3-billion in revenue last year. The phone has also helped fuel growth at Broadcom, which refers to Apple as its “large North American customer” during earnings calls. The chip maker makes a combined component that handles both Wi-Fi and Bluetooth functions on Apple devices.

Apple is developing an in-house replacement for that chip and is aiming to start using it in its devices in 2025, people say. In addition, it’s already working on a follow-up version that will combine cellular modem, Wi-Fi and Bluetooth capabilities into a single component.

‘the best’

A representative for Cupertino, California-based Apple declined to comment. Broadcom and Qualcomm didn’t have an immediate comment.

Broadcom still supplies Apple with other components — including radio-frequency chips and ones that handle wireless charging — though the iPhone maker has been working on customizing those parts as well.

During a conference call last month, Broadcom CEO Hock Tan expressed confidence that his company will maintain its foothold at Apple.

“We believe we have the best technology and delivering value to our customers,” he said. “There’s no reason to find something else where you’re not the best.”

With the shift away from Qualcomm modems, Apple plans to initially just use its homegrown component in one new product, such as a high-end iPhone model. It will then gradually move away from Qualcomm modems during a period it anticipates will take about three years — similar to how it handled past transitions.

But the swap hasn’t been easy so far. After aiming to launch its own cellular modem by this year, the company faced problems with overheating, battery life and getting the components validated. The iPhone currently works with more than 100 wireless carriers in over 175 countries, which requires a lengthy and cumbersome testing process.

But the swap hasn’t been easy so far. After aiming to launch its own cellular modem by this year, the company faced problems with overheating, battery life and getting the components validated. The iPhone currently works with more than 100 wireless carriers in over 175 countries, which requires a lengthy and cumbersome testing process.

A cellular modem is what allows iPhones to handle phone calls and connect to the Internet while away from Wi-Fi, making it the most critical part of the device for most people. If Apple’s offering was inferior to Qualcomm’s component, it could put the company’s flagship product at a significant disadvantage.

The long transition could also put Apple in a tricky position. The company will still need to rely on Qualcomm for several years as it replaces the component in various devices.

Read: Apple dramatically scales back its EV ambitions

Apple first started work on its modem around 2018, opening an office in San Diego near Qualcomm’s headquarters. To speed up development, the company acquired Intel’s modem unit in 2019 for $1-billion and opened additional offices in key areas known for wireless technology development.

The Wi-Fi and Bluetooth chip effort is newer, and a release will take longer. But Apple has already made some wireless chips in the past, including the H2 processor found in AirPods and the W3 chip found in Apple Watches.

Read: Apple’s stock is losing its shine

Apple and Qualcomm were embroiled in a legal war over royalties and patents related to modems until a settlement in 2019. At the time, Apple deemed the truce necessary to bring 5G support to the iPhone in 2020. The companies agreed that Qualcomm would supply parts to Apple through to 2024.

Apple also has a strained relationship with Broadcom. Tan, the chip maker’s CEO, has a reputation for tough negotiations and forced some customers to commit to non-cancellable orders during the pandemic-fuelled supply crunch.

Read: Apple to allow third-party app stores on the iPhone

In 2020, Apple said it was spending a total of $15-billion on purchases of Broadcom chips in an arrangement running through to the middle of 2023. But despite Apple being Broadcom’s top customer, Tan’s commitment to the market has occasionally wavered. Prior to the 2020 agreement, Tan indicated that Broadcom might divest the business that supplies chips to Apple. — Reported with Ian King, (c) 2023 Bloomberg LP